Base metals hit yearly lows on a weaker demand growth outlook

Vrasidas Neofytou

Head of Investment Research

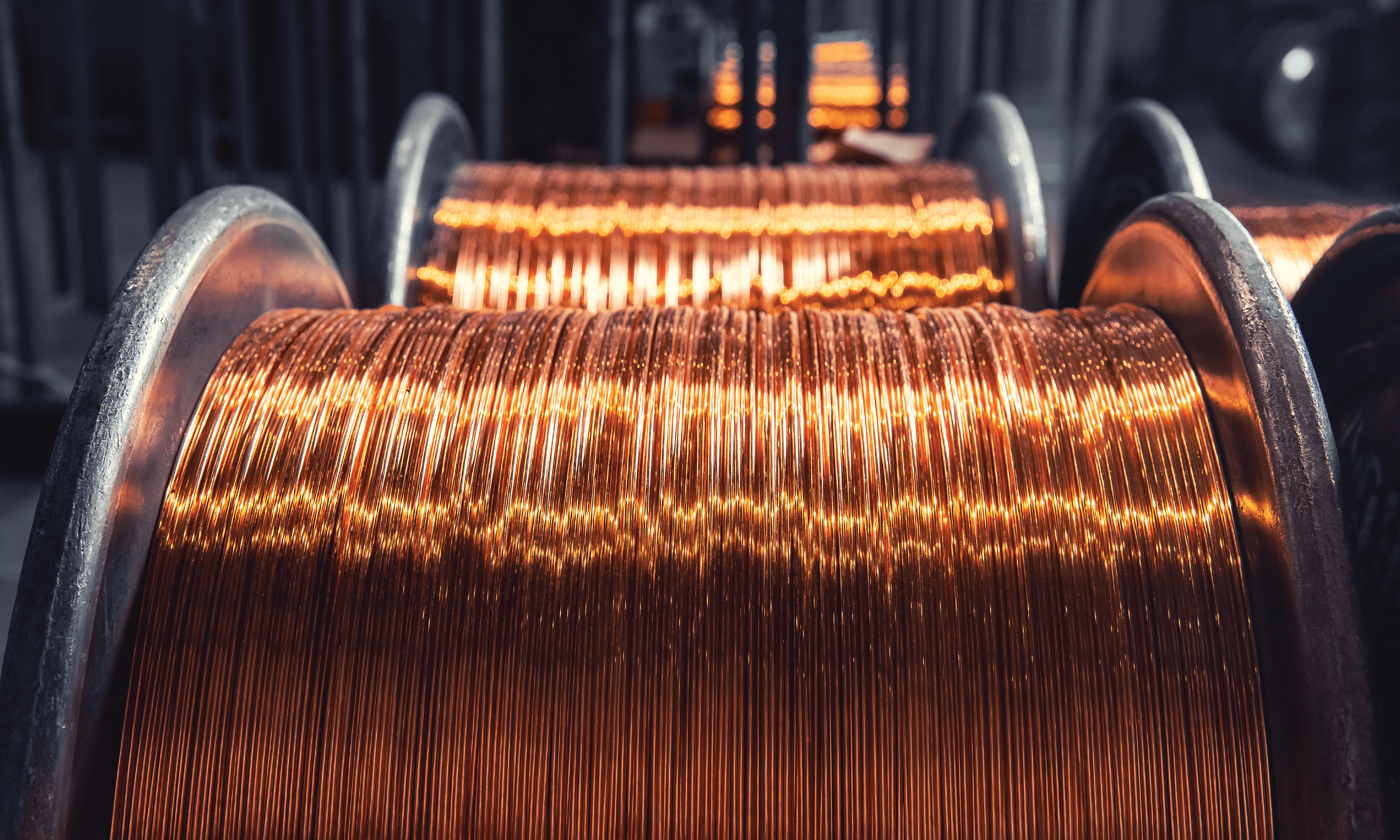

The price of copper fell as low as $3.66 a pound on Friday morning, its lowest level since November 30, 2022, as the deteriorating global economic outlook weighs on the demand growth outlook for the base metals.

Copper, Daily chart

Copper has lost nearly $0.30 cents or over 12% since Monday’s intraday high of $3.95/lb and is on pace for its worst week since the end of January, while Aluminum, the other major industrial metal also fell 3% yesterday to $2,216/lb, its lowest since October 31, 2022, and nearly 8% on the week.

Similar selling pressure is seen on the other major base metals as well, with the price of Nickel slipping 3.1% to $21,825, also after touching its lowest since October 31 at $21,710, Zinc fell 3.1% to $2,543, after hitting $2,537, its lowest since November 2020, Lead was 1.3% lower at $2,126.3 and Tin was down 2.4% at $25,220.

The selloff on Copper and Aluminium intensified yesterday as the weaker-than-expected inflation data from China added to concerns over the strength of the country’s economic post-pandemic recovery, and hence their demand growth outlook.

Investors have turned sellers of industrial metals this year in response to continued concerns about the global economic outlook and especially the faded construction and infrastructure post-pandemic recovery in China, boosted by the latest signs that the domestic demand was not as strong as many were expecting.

The softening economic conditions in China and USA, the world’s two largest consumers of industrial metals weigh on the prices, since China’s economy still struggles to turn up after the lifting of COVID curbs in December 2022, while the growth in the U.S. economy is under threat after the recent banking turmoil and some weaker macroeconomic data.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.