Is the market right to worry about inflation expectations?

George Kessarios

Chief Economist & Fund Manager

Inflation scares have been around for years. In fact, there has never been a moment over the past 20 years or so that market pundits have not reminded us about the dangers of inflation, as a result of Central Bank policies.

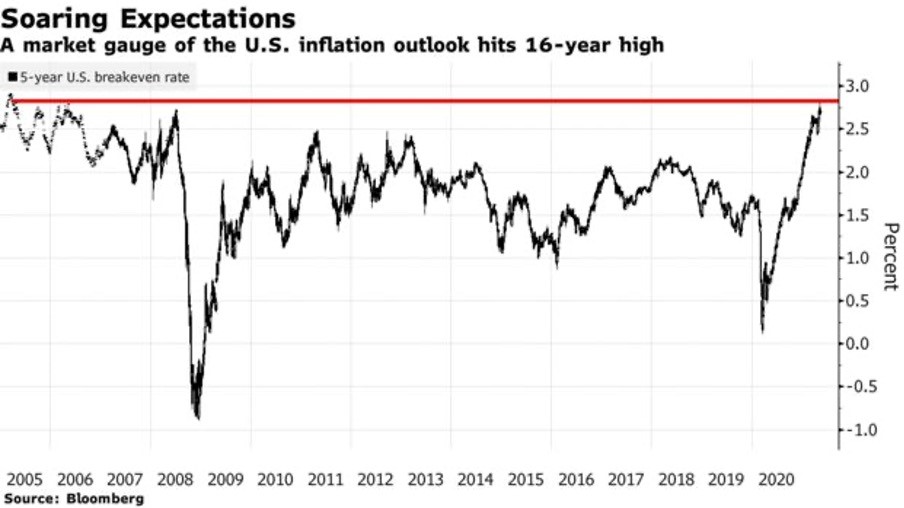

The word on the street over the past several weeks has been that inflation is roaring back. As a result, the market will correct because of higher interest rates ahead (they say). In fact, as Bloomberg reported, inflation expectations are at 16-year highs.

So, let us talk about inflation. Yes, inflation this year and perhaps next year will be elevated, but from the very subdued levels of 2020 (the Covid year). Also, the last time inflation was above 4% was towards the end of the previous financial crisis. As a rule of thumb, inflation tends to spike when exiting a recession.

However insofar as interest rates are concerned, it took the Fed many years to feel comfortable raising rates, and even then, at an anaemic rate of 2.5% in 2019. But raising rates back then almost threw the US economy into recession, that forced the Fed to take everything and introduce extraordinary accommodation actions. This even before COVID.

Yes, bond yields have moved up a bit over the past several months, but this is more of a reflex reaction of markets. I don’t think it’s a sign of long-term inflation returning, or that yields will be spiking a lot higher, thus prompting investors to sell equities and move to treasuries.

The Fed will not make the same mistake in made in 2019, raising rates for the sake of raising them, that almost threw the US economy in recession. Also, the fact that the Fed continues to purchase assets, will deter yields from moving much higher.

And yes, real rates will continue to be negative, perhaps for years. However, this is also not a reason for Central Banks to raise rates and threw economies into recession. The extraordinary accommodation Central Banks are providing will be with us for a very long time to come.

The bottom line is that I would not worry much about inflation. As the Fed and ECB have said, inflation will be transitory. Longer term, demographics and technology are still deflationary forces, and will most likely overtake inflationary forces. So, while markets might correct as inflation ticks up a bit, chances are a correction will be another dip buying opportunity.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.