No relief for equities yet

George Kessarios

Chief Economist & Fund Manager

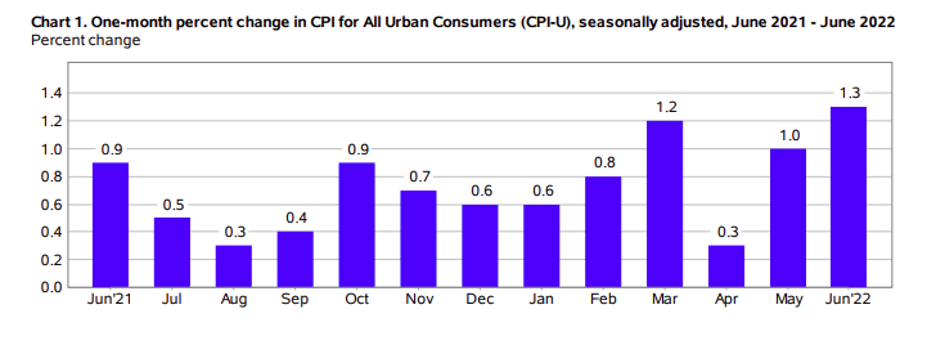

The latest CPI print for June from the BLS in the US was 9.1% on a Y/Y basis, the highest since November of 1981. Economists were expecting an increase of 8.8%. On a monthly basis, prices increased 1.3%, up from the 1% in May, which might mean price increases are accelerating. (Source BLS)

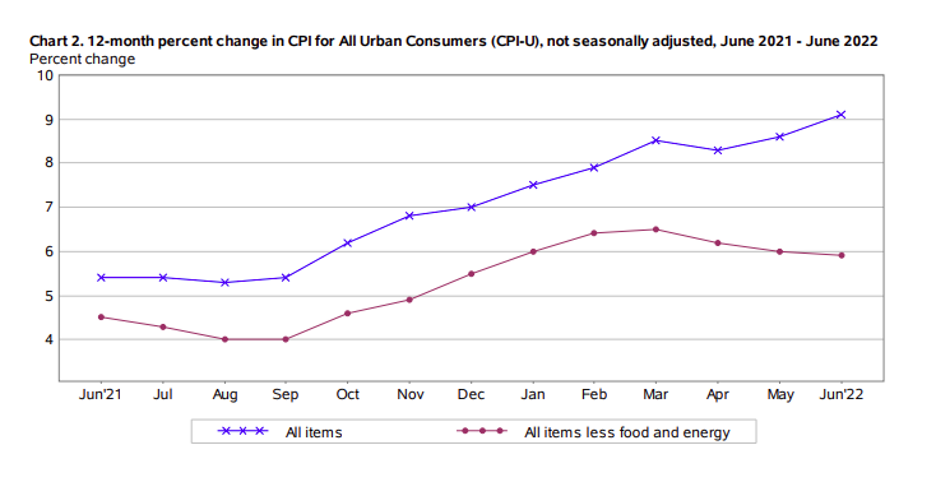

On a positive note, excluding food and energy, prices are continuing to go lower, with core inflation (what the Fed supposedly mostly looks at and acts upon) falling just under 6%.

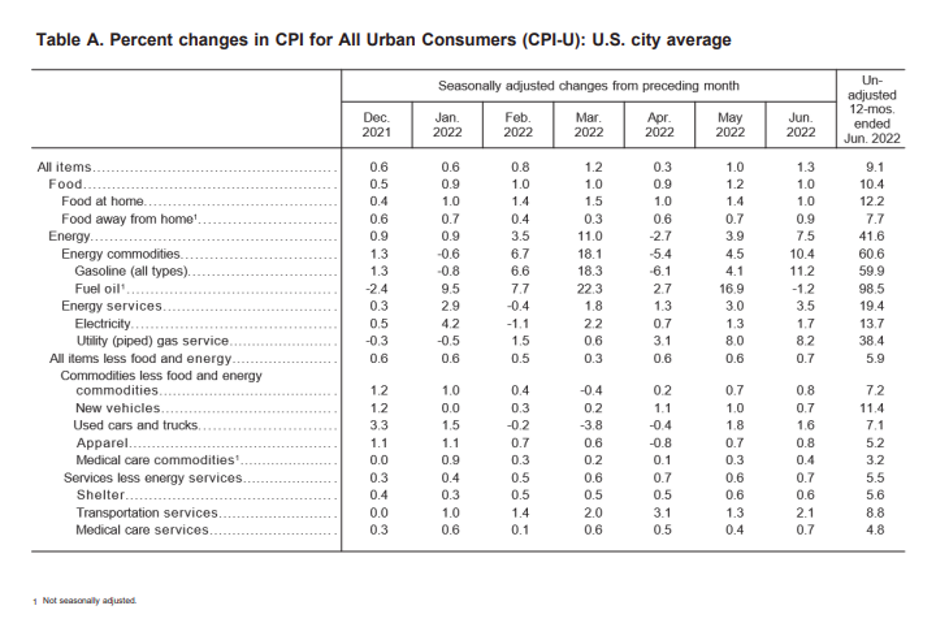

But when take a close look at the BLS data, we find them mostly to be about energy.

In fact, energy overall was up 41.6%, with fuel oil leading the energy pack of 98.5%.

The problem with the latest BLS report is that there are many components which the Fed does not control, energy being the most obvious. So, while we are seeing deflation in many CPI components, the inflationary parts outweigh. The trick for the Fed is how to cause more deflation in parts that it controls, to overtake the parts it does not control. Housing is of particular importance, because interest rates have a direct impact on housing, and the transmission of policy is faster and with surgical accuracy.

At the same time the Beige Book was also published on the same day. The report was mixed, with many districts reporting a slowdown in demand, and districts also noted an increased risk of a recession. Housing demand has decreased notably because of affordability concerns, but supply chain problems continue to exist. And the report ends noting:

“the outlook for future economic growth was mostly negative among reporting Districts, with contacts noting expectations for further weakening of demand over the next six to twelve months.”

So, the Fed is slowly getting what it wants, although continued high energy prices are preventing it from declaring victory.

The question now is what will the Fed do next? Many financial commentators noted the Fed needs to raise rates by 100 basis points in its next meeting, as opposed to the guidance of 75. My take is that will only add more uncertainty to market participants and asset prices, particularly to equity prices. As such, while equities have retreated for some time now, and higher rates are already priced in the market (hopefully), if the Fed does become more aggressive than it already is, all bets are off and market participants will have to think about their strategy once again.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.