Brent crude falls to a 3-month low of $81 on weaker oil fundamentals

Vrasidas Neofytou

Head of Investment Research

Both Brent and WTI crude oil prices tumbled over 4% on Tuesday, to have their lowest finish since end-July of $81.61/b and $77.37/b respectively, on the back of a slowdown in China’s oil demand and fuel exports, and the rising inventories, despite the fear of supply disruptions in the oil-rich Middle East.

The ongoing geopolitical crisis in the Mideast hasn’t impacted global crude oil supplies yet, as the U.S. and EU diplomacy has been working determinedly to avoid a spread of the tension in the region.

In this context, the crude oil prices have lost almost the entire “geopolitical risk premium” added after the unexpected attack of Palestinian Hamas on Israel on 07 October, losing nearly $13/b or almost 13% since topping at $94/b in mid-October.

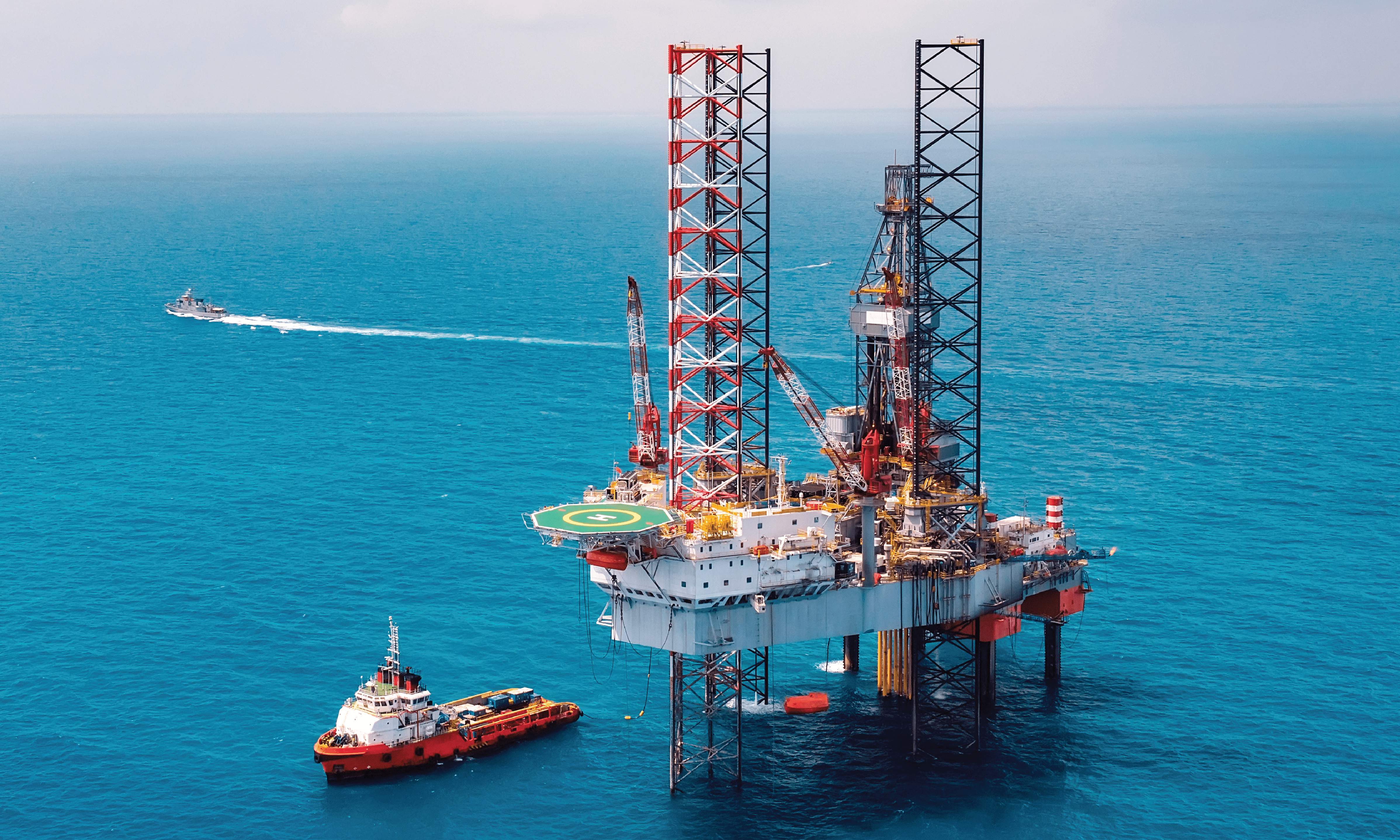

Brent crude, Daily chart

Crude oil prices have been also easing despite the heightened uncertainty around the ground invasion of Israel to Gaza, and the potential for tensions to spread to a wider area in the oil-rich Middle East and Persian Gulf.

On the supply front, the U.S. crude oil production has climbed to its highest level on record, topping 13 million barrels per day in October according to the Energy Information Administration, and it’s expected to continue its rise next year, raising doubts over just how tight supplies would remain, which would add further pressure on the crude oil prices into 2024.

Hence, the selling pressure on crude oil prices has intensified this week as a series of weaker-than-expected economic data around the world have indicated the potential for a slowdown in crude oil and petroleum products demand.

The softer economic data from China, the second-largest oil consumer in the world after the USA- and the lower petroleum exports from the Chinese refineries (they reached the end of government export quotas) would result in lower demand for crude oil import, leading to higher crude inventories, which is a bearish signal for the crude oil prices.

Adding to the Chinese economic growth worries, some industrial countries in Europe, such as Germany, France, Italy, and the UK have posted weaker-than-expected manufacturing and services activity in October, indicating the risk of lower demand for petroleum products.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.