All roads lead to equities

George Kessarios

Chief Economist & Fund Manager

- Do record low junk bond yields mean this asset class is overpriced?

- Record low yields are making a case for higher equity valuations.

- In a world where all roads lead to equities, don’t expect valuations to come down soon (if at all).

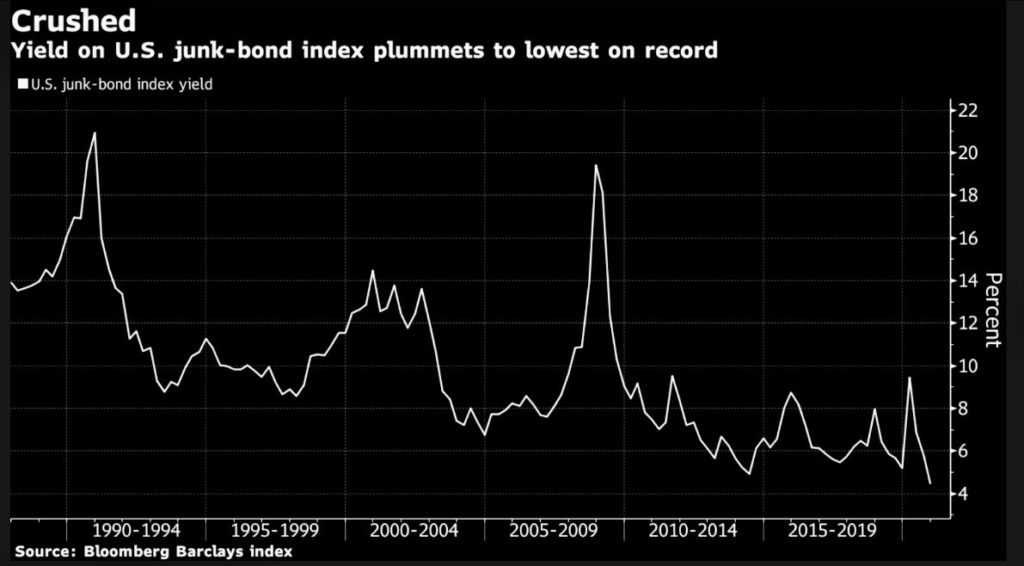

The chart below depicts the yield of the Bloomberg Barclays Junk bond index. As you can see, the current yield is slightly above 4%, a record low mark.

The question is, is the search for yield pushing yields in artificially low territory, and does this mean Junk Bonds are in a bubble? This is a very difficult question to answer. On the one hand lower bond yields will lead to lower debt rollovers in the future, which will might fix many balance sheets, and on the other, with yields nowhere to be found in sovereign paper, getting 4% might be worth the risk.

However insofar as equities, this means that a higher PE multiple is justified, and that a PE of around 25 might be the new norm, as we have said several times over the past several months.

In addition, there are so many stocks that offer a higher dividend yield than most sovereign bonds these days, it makes us wonder that if investors who must have yield, might be forced to buy stocks, and take on the inherit risk embedded in equities.

The bottom line is that anyway one looks at bond yields, be it sovereign or corporate bonds, the case for equities is magnified. In other words, in a post COVID world, all roads lead to equities. And in my opinion, don’t expect the record high multiple of the S&P 500 Index to come down soon, if at all.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.