Yearly Outlook 2021: Cautiously hopeful

George Kessarios

Chief Economist & Fund Manager

We all know economies will experience a burst of growth with the introduction of a COVID vaccine that will hopefully lead to an end of the current pandemic. Part of the growth will come from pent-up demand, part from increased productivity (gained during the pandemic), and lastly growth due to the return of sectors like hospitality, which are almost non-existent today. However, with 93% of economies around the world locked down and struggling from the pandemic, it’s hard to make a case for a return to pre-COVID normality anytime soon.

Assessing economic growth and trying to predict what markets will do in 2021 is a great challenge, because many of the implications of the 2020 crisis have yet to manifest themselves. Not only are the long-term health repercussions of the pandemic still unknow, but there are many questions pertaining to the state of small businesses, hospitality, and a host of other sectors that have been affected by the pandemic.

Furthermore, unemployment is still a concern. The outlook for the labor market in Europe is of particular concern. Increased unemployment and increased long term unemployment are issues central bank liquidity cannot address.

We have all noticed the divergence between economic activity and market performance. Many (myself included) have wondered why. One explanation is that the liquidity created by central banks has increased the multiple in equity markets. Also, the low interest rate environment is another reason that should not be underestimated.

Please note central banks will provide accommodation for a considerable for the foreseeable future. In fact, the Fed has said that the economy needs accommodation for a considerable period, even with inflation above 2%. This is something the Fed has repeated many times, and thus we find it difficult to see a scenario where markets crash or correct considerably as they did in the beginning of the pandemic.

Irrespective of inflation, interest rates should remain low because central banks have unlimited firepower to keep them close to zero. As such our base case for interest rates is that they will remain at current levels for many years. In fact, this has been my base case for over a decade.

But market participants are conditioned to react to higher inflation. Their reaction, is usually, to sell equities preparing to move into bonds thinking rates will go up. But since interest rates will remain low, it is doubtful is if we see an exodos from equities to hide in bonds. Not only is there no yield anywhere to be found, but you can get a better yield in equities. So, it is difficult to fathom any kind of exit from equities, no matter what the inflation outcome is in the future.

So, while inflation is possible, central banks have the tools to keep interest rates at bay. A byproduct of such a policy is more liquidity in the economy and markets.

Will 2021 turn out to be a sell the news event?

So, will 2021 be a correction? Will market participants sell the COVID19 vaccine? We don’t know, but even if the market tries to correct, the additional liquidity from central banks will probably prevent such an outcome. However, the truth is that we don’t know what will happen, especially since valuations are so rich.

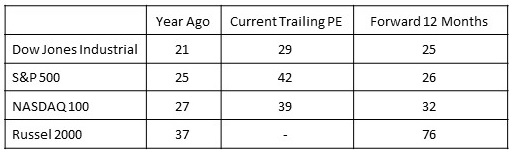

As you can see in the table above, the trailing PE ratio of the S&P is 42. Granted this is a high number because of depressed earnings due to the pandemic, however if we look at forward 12-month estimates, they are higher than the multiple pre-COVID. In the case of the Russel 2000, the multiple is almost double that of last year.

These valuations are very hard to swallow, even for those who justify a higher multiple because of the liquidity created by central banks. So, earnings have to increase by a lot in 2021 to reach last year’s multiples. But there are many uncertainties to such a scenario.

So, our base case for 2021 is that markets at best, will remain flat. And even if markets do go up, it will most likely be in the single digits at best. Valuation headwinds will probably prevent markets from continuing to expand the multiple, as has been the case over the past several years.

The Dollar is losing ground against most currencies, which is a good thing

As we have noted in the past, a weak dollar is good for the global economy and is supportive for global growth, especially for EM economies. A lower dollar helps companies and countries service their dollar debts, but also helps consumers around the world purchase iPhones. Historically, a lower dollar has been associated with a risk-on trade and better market returns. So, to the extent the dollar continues to drift lower, this should help support the global economy.

While we have no target for the EURUSD pair or the dollar Index, we are modeling a lower dollar for 2021. However, we do not expect the kind of moves we witnessed in 2020. The move from 1.08 to 1.22 in the EURUSD pair has not happened for over a decade. If the dollar continues to drift lower as we think, the rate of decline will be at a much slower pace than in 2020.

Will the rotation trade continue? Anecdotal evidence suggest it should.

As you have probably noticed, there is a lot of talk about an ongoing rotation trade. In other words, selling high momentum growth stocks and buying stocks that have a lower multiple or cyclical plays.

The chart above depicts the ISHARES 1000 value ETF (IWD) vs the ISHARES 1000 growth ETF (IWF). As you can see, growth did not always outpace value. After the crash in 2000, value was a far better choice than growth. And while after 2007 growth has done better, that will not always be the case.

The main reason why we are currently favoring value, is because of the extreme valuation of growth stocks. Simply put, most stocks that I come across are simply not investable due to valuation concerns. So, if we assume a rotation trade is happening (or will happen), this can last for years, not days or weeks.

Economies will continue to struggle despite a vaccine rollout

A double-dip recession is possible despite a vaccine rollout. Things are not great at the moment, and we do not anticipate a return to normality for at least 18 more months.

We are expecting many companies to become insolvent, despite fiscal help. Unfortunately, all the liquidity in the world cannot make up for lost business, especially if a company is leveraged.

Small businesses in many countries are in very bad shape, and it is doubtful most will make a comeback.

While everyone agrees that banks in this crisis are better off than during the 2008 crisis, nevertheless, there are still many unknows insofar the future quality of bank balance sheets, especially in Europe.

Solvency is still a problem

Remember, liquidity is not a substitute for a problematic balance sheet. This applies to both corporates and sovereigns, but also to individuals. While the solvency problem of the average consumer has been well managed in the US with the PPP program, the same cannot be said about Europe or the EM space.

In addition, many sectors like hospitality are permanently damaged. Many companies like airlines still need massive capital increases to stay solvent. Many other companies in the hospitality space will probably stay closed forever.

Central banks all over the world are pushing for fiscal help from governments. The US government alone will probably spend over $1 trillion in 2021. While the US government has the means to provide this assistance, most governments around the world can’t. This is especially true of countries in Africa.

What to expect in 2021

We do not expect equity markets to rally like they did in 2020. At best we think equities will be up in the single digits (if at all). The main reason being valuation headwinds.

Inflation should continue to remain low, and interest rates should remain at current levels or lower.

We do not think the dollar will be a safe haven in 2021. On the one hand the Euro is currently in style, and if inflation does resurface in the US, ultra-low interest rates will probably deter dollar investment flows, even in a risk off scenario.

While volatility is off its high, it is still stubbornly high and refuses to fall. The resurgence of COVID cases in many countries and the fear of a double dip recession is likely to keep volatility elevated during 2021.

While the popularity of passive ETF investing has been popular for many years, investors will actually have to do the work and pick individual names in 2021 if they want to make money.

The EM space will outperform western markets, and Europe will probably outperform the US.

About one third of sovereign bonds are in negative territory. This will likely increase in 2021.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Exclusive Capital communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.