Market Brief, Thursday, 23rd of July, 2020

Asian markets fell 1% this morning in response to the rising tensions between US and China, after Trump’s administration ordered the closure of China’s consulate in Houston amid accusations of spying.

US futures moved slightly lower this morning following the escalation of geopolitical tensions after Chinese authorities threatened to close one of the five US consulate offices in the country as retaliation over Houston.

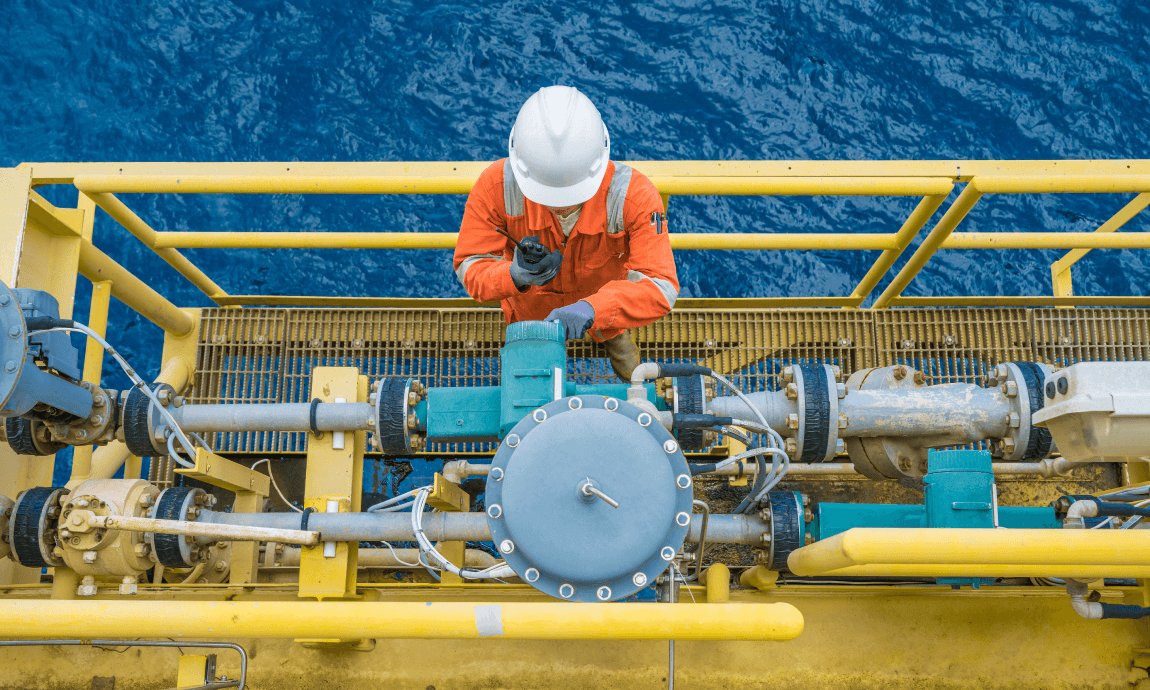

Crude oil prices edged lower after the US government data showed a surprise rise in U.S. crude inventories while fuel demand slipped last week, as the sharp outbreak in coronavirus cases has damaged US fuel consumption.

Precious metals have extended their massive rally as an escalation in U.S.-China tensions fueled demand for safety. Gold prices hit fresh 9-year highs, while Silver rallied for a third straight day to a new seven-year high.

The US dollar was weaker across the board yesterday, falling to its lowest since early March, as the sinking US real yields are driving investors out of the dollar.