The tech-heavy Nasdaq Composite tumbled nearly 3% on Tuesday, posting its sharpest pullback since March, as rising US Treasury yields, Fed’s chair Powell comments, and weaker economic data triggered a selling pressure in shares of fast-growing technology companies.

Nasdaq Composite underperforms the market:

US stock market experienced a fierce sell-off yesterday, with Nasdaq Composite losing 2.83% to 14,546, posting its worst day since March, the S&P 500 dropped 2.04%, and the Dow Jones Industrial Average lost 570 points, or 1.63%.

The leading tech index has been underperforming the broader equity market since it posted its all-time high of 15,700 on 06 September, logging nearly 5% monthly losses so far, having exactly the inverse relationship with the upward trend in US bond yields.

Growth stocks vs bond yields:

Wall Street’s favourite tech giants Apple, Amazon, Facebook, Google-parent Alphabet, and Microsoft fell more than 2% yesterday, as the rising bond yields have a significant implication in the economic outlook and the future earnings of the tech-led growth stocks.

Tech names were the investor’s darlings during the pandemic era, logging significant gains versus the cyclical names which depend mostly on the economic conditions of the market.

The sell-off accelerated after Federal Reserve Chairman Jerome Powell told the Senate Banking Committee that inflation could stay “elevated” longer than the central bank had previously predicted.

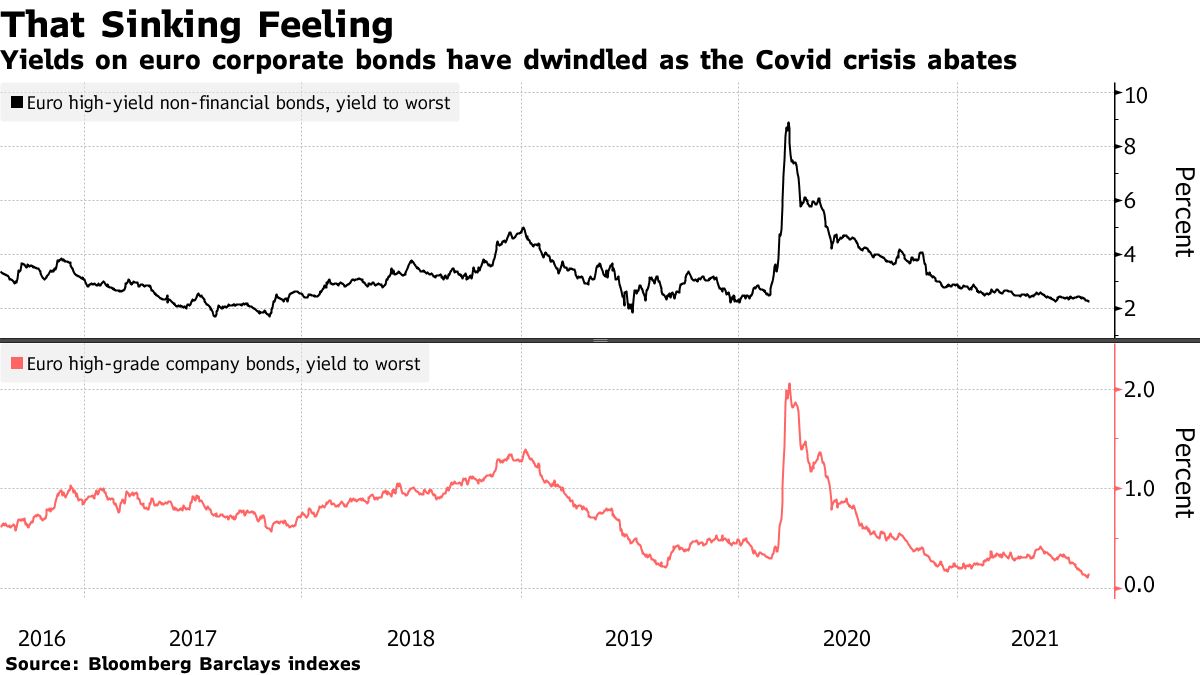

The 10-year US Treasury yield rose as high as 1,57%, the 30-year US Treasury yield touched the 2,10% mark, posting their highest level since June on economic optimism and inflation fears.

Investors worry that elevated inflationary levels will encourage Federal Reserve and other central banks around the world to start tapering their pandemic-led massive monetary stimulus measures just as global growth and economic data start to deteriorating.