Commodity Update, Thursday, 9th of July, 2020

Commodity prices extended their gains this week, gaining support from stronger demand as economies and industries restarted, offsetting the risk for a second pandemic wave, especially in the US and China, the world’s two largest consumers of commodities.

Crude oil contracts advanced above $40 per barrel this week based on the hopes for a global economic recovery based on the recent improved macroeconomic data around the world, and tight supplies from Saudi Arabia and other OPEC members.

Furthermore, oil prices boosted from the declining US gasoline inventories, a sign for rising fuel consumption during the summer driving season, despite the growing virus infections in the country.

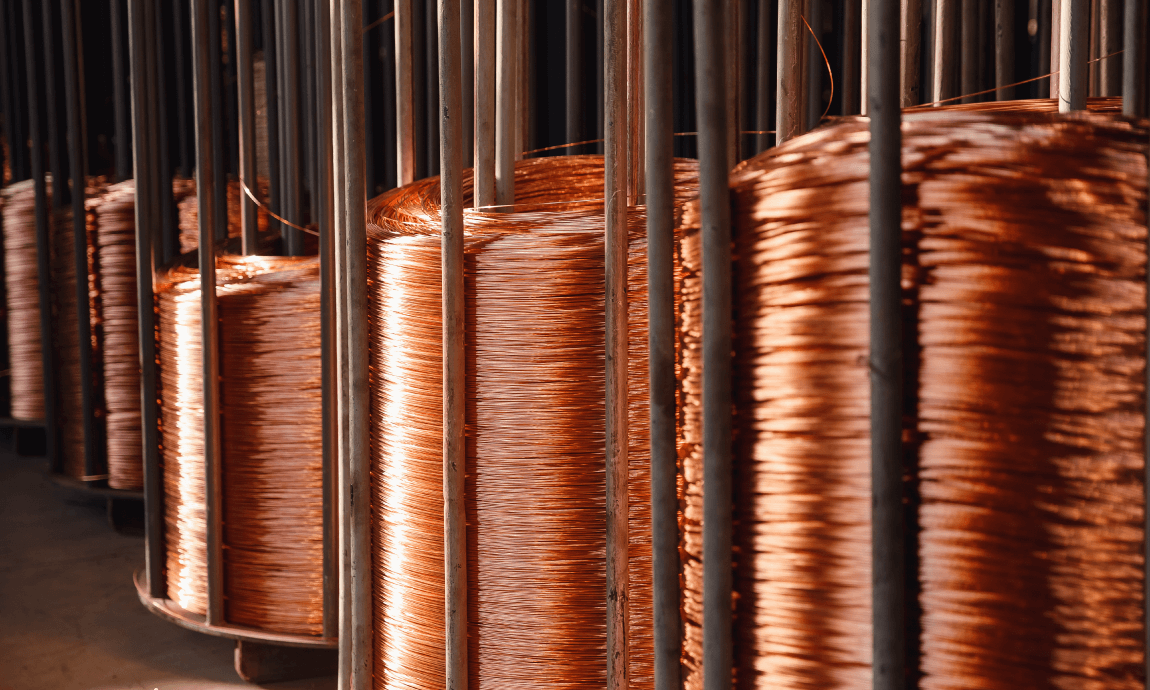

Copper prices continued their uptrend momentum this week, breaking above 2,80 dollars per pound. The price of red metal recovered 40% from its low in March, returning to pre-pandemic levels in response to the improved industrial demand from China and supply disruptions copper mines in Chile.

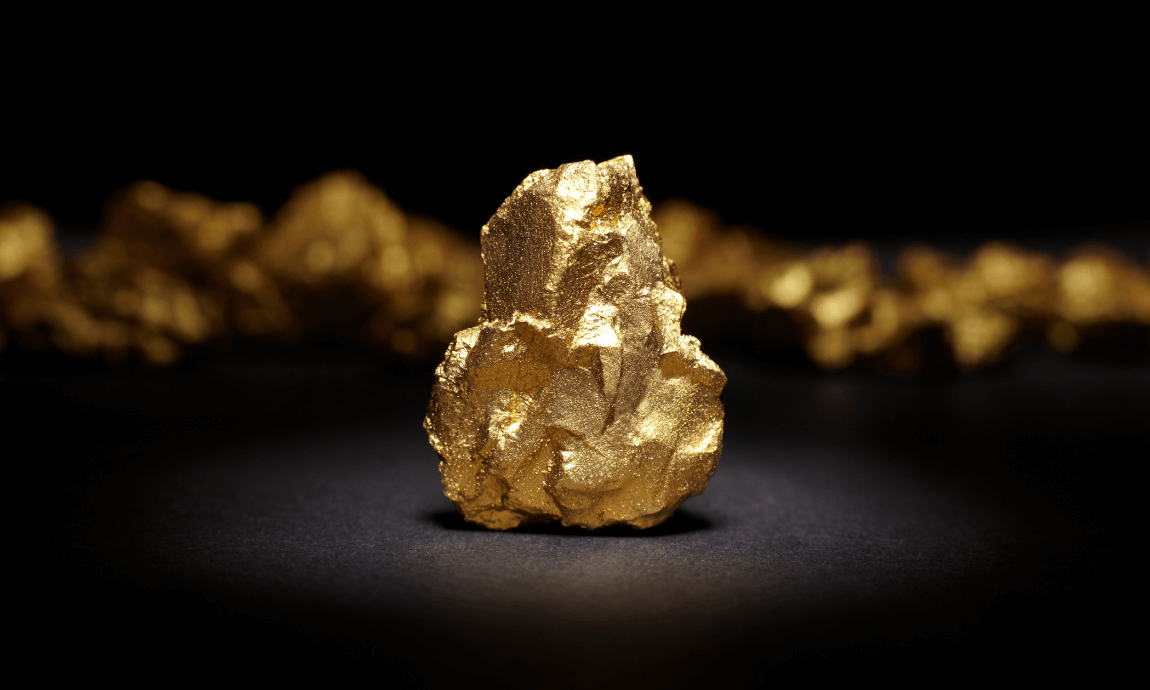

Looking at the precious metals, we can see that the price of Gold trades above $1.800 per ounce level, hitting its highest level since 2011, while Silver price climbed to $19 level. Both metals gained support from the massive fiscal and monetary stimulus, the zero interest rates, the weaker US dollar, and the fear for the second wave of the pandemic.