Industrial metals have lost their popularity recently, with prices falling sharply from their multi-year highs as China tries to cool off soaring commodities prices, coupled with the rebounding US dollar and the prospects for Fed’s rate hikes in 2023.

Growth-sensitive commodities have been on a bullish uptrend, making higher highs since last summer, driven by a stronger-than-expected post-pandemic demand recovery, especially from industrial-led Asian economies combined with tight supplies and falling inventories.

Commodities under pressure amid a stronger US dollar:

The expectations that Federal Reserve will start hiking interest rates in 2023 and tapering its massive pandemic-relief stimulus have bolstered the US dollar and US Treasury yields, causing a widespread sell-off in the commodity market.

The DXY-US dollar index against six major peers hit a two-month high of 92 level and was headed for its best week in nearly nine months, making dollar-denominated commodities more expensive for holders of other currencies.

China’s crackdown:

However, the main reason behind the recent weakness across the board has been the willingness of China to rein in surging commodities prices fuelled by robust industrial and manufacturing recovery after pandemic in the country.

China, which is the world’s top consumer of commodities, plans to release the state’s strategic reserves of key industrial metals, such as copper, zinc, and aluminium to push ballooned prices back to a normal level.

Industrial metals have risen by more than 50% since March 2020, lifting the Chinese producer inflation towards 12-year highs, damaging the demand growth in the Chinese economy.

Market Reaction:

Despite the global economic recovery which supports the demand for raw materials, the entire industrial metal complex has been hit hard in recent weeks.

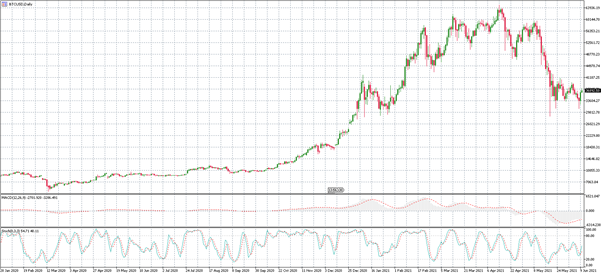

Copper, the de-facto leader in the industrial metal sector, posted a fresh 2-month low of $4,15/lb on Friday morning, down by almost 15% since topping at $4,85 in mid-May.

Copper, 4-hour chart

Hence, the prices of the other industrial metals, Palladium, Platinum, and Aluminium have also lost more than 10% in the period, while Lumber (which is been used also in the construction industry) hits hard the most by losing more than 50% from historic records reached on early May.