Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

That was Fed’s 10th interest rate increase in just over a year in its fight against persistent inflation, which stood at 5% y-y in March 2023, still well above the 2% target that policymakers consider optimum.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

That was Fed’s 10th interest rate increase in just over a year in its fight against persistent inflation, which stood at 5% y-y in March 2023, still well above the 2% target that policymakers consider optimum.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

The benchmark borrowing rate sets what banks charge each other for overnight lending but feeds through to many consumer debt products such as mortgages, auto loans, and credit cards.

That was Fed’s 10th interest rate increase in just over a year in its fight against persistent inflation, which stood at 5% y-y in March 2023, still well above the 2% target that policymakers consider optimum.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

The benchmark borrowing rate sets what banks charge each other for overnight lending but feeds through to many consumer debt products such as mortgages, auto loans, and credit cards.

That was Fed’s 10th interest rate increase in just over a year in its fight against persistent inflation, which stood at 5% y-y in March 2023, still well above the 2% target that policymakers consider optimum.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

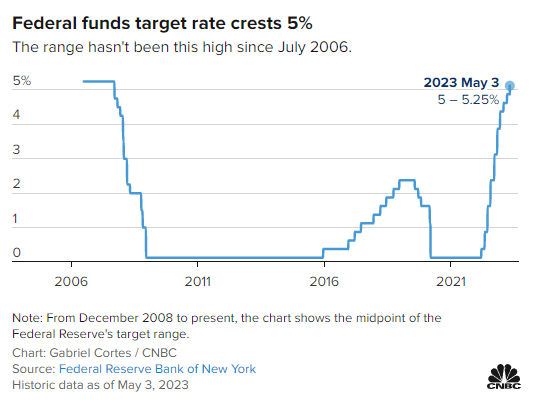

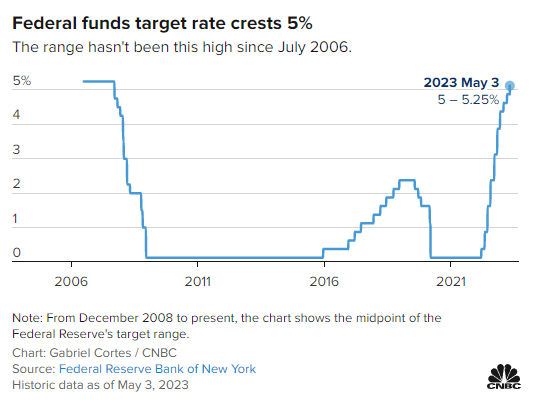

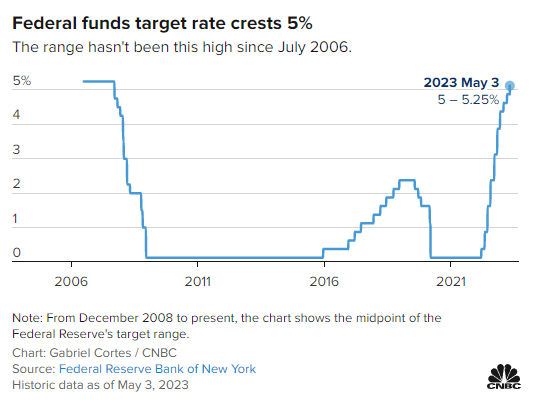

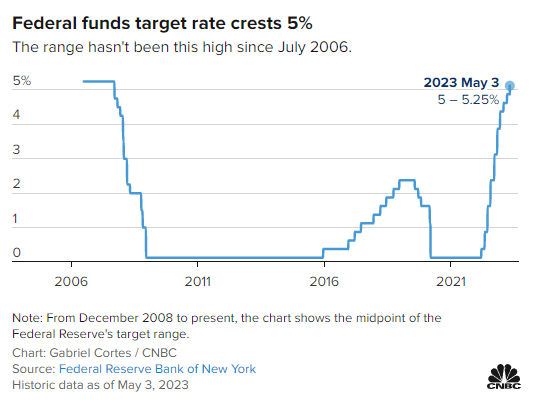

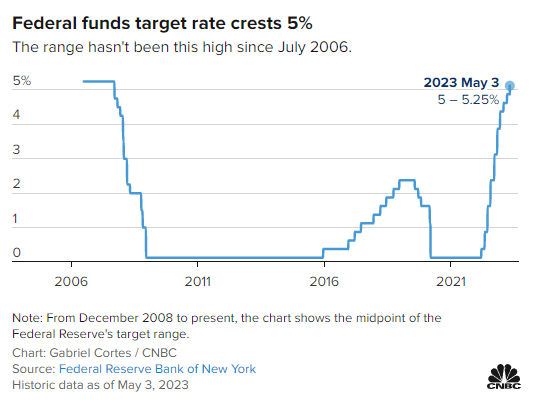

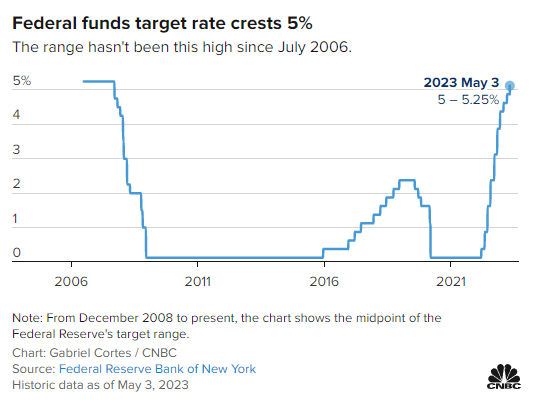

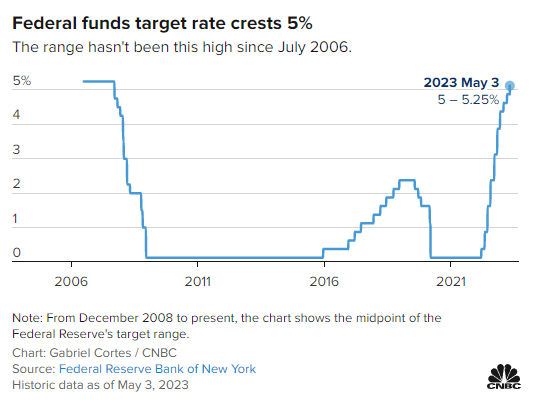

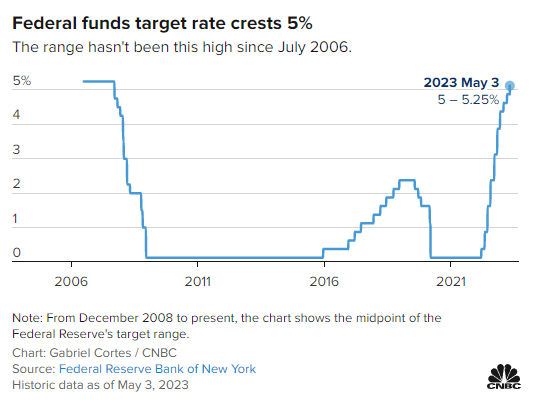

The world’s largest central bank -Federal Reserve- raised its fed funds borrowing interest rate by 25 bps to a target range of 5% to 5,25% on Wednesday night, as widely expected, putting them at their highest level since August 2007.

The benchmark borrowing rate sets what banks charge each other for overnight lending but feeds through to many consumer debt products such as mortgages, auto loans, and credit cards.

That was Fed’s 10th interest rate increase in just over a year in its fight against persistent inflation, which stood at 5% y-y in March 2023, still well above the 2% target that policymakers consider optimum.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.

The world’s largest central bank -Federal Reserve- raised its fed funds borrowing interest rate by 25 bps to a target range of 5% to 5,25% on Wednesday night, as widely expected, putting them at their highest level since August 2007.

The benchmark borrowing rate sets what banks charge each other for overnight lending but feeds through to many consumer debt products such as mortgages, auto loans, and credit cards.

That was Fed’s 10th interest rate increase in just over a year in its fight against persistent inflation, which stood at 5% y-y in March 2023, still well above the 2% target that policymakers consider optimum.

Adding to the above rate decision, Fed Chair Powell opened the door to a pause in Fed’s aggressive tightening cycle following the deteriorated economic and banking conditions in the United States, sending lower both the dollar and bond yields as investors see a peak in U.S. rates.

In the press conference after the rate hike, Powell warned that economic growth was cooling and that credit conditions were likely to tighten further amid growing pressure on U.S. banks, forcing the FOMC to water down its language regarding the need for additional monetary tightening.

Hence, the rate decision was accompanied by growing fears over the health of the U.S. banking system, as many regional banks tumbled in the after-hour trading amid reports that regional lender PacWest Bancorp was considering a sale amid worsening market conditions, suggesting that it could be the next domino to fall in the worst U.S. banking collapse since 2008.

Market reaction:

The banking turmoil, the worsening economic conditions, the worries over a U.S. recession, and the potential pause in future rate hikes, have all pressured the DXY-U.S. dollar index to monthly lows of the 101 mark, while the yield on the 2-year and 10-year Treasury Bills fell as low as 3.80% and 3.34% respectively, before bouncing higher during the day.

The weaker dollar boosted major peers, with Euro climbing up to a yearly high of $1.11, ahead of the ECB rate decision later today, the Pound Sterling rallied toward an 11-month high of $1.26, while the traditionally safe-haven Japanese Yen rose to ¥134 a dollar from increased haven demand.

Precious metals benefited from Fed Chair Powell’s tone and resumed banking turmoil, with the price of Gold briefly touching a record high of $2,080/oz before retreating lower to near $2,030/oz, while Silver also rallied toward a recent high of $26/oz, as the weaker dollar and falling bond yields make the dollar-denominated bullion less expensive for buyers with foreign currencies.