The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

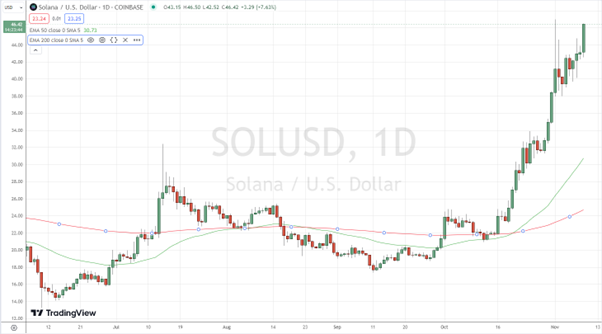

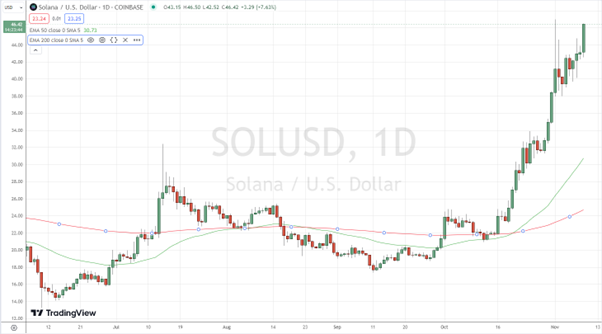

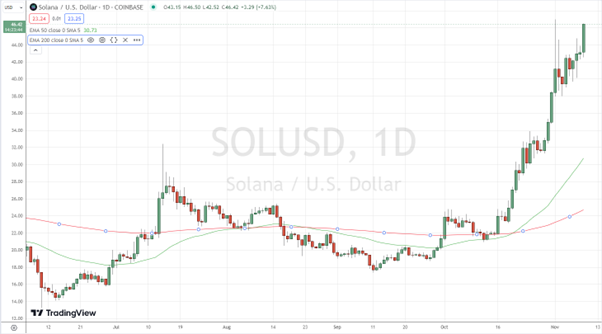

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

The jobs growth slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labour market will likely be needed to keep inflation on its downward trajectory.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

The jobs growth slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labour market will likely be needed to keep inflation on its downward trajectory.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

The appetite for risk assets such as stocks and growth-sensitive currencies lifted last Friday, as the cooler-than-expected U.S. NFP jobs report for October drove the 2-year and 10-year Treasury yields as low as 4.80% and 4.50% respectively, boosting all 3 U.S. stock indices to monthly highs.

The jobs growth slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labour market will likely be needed to keep inflation on its downward trajectory.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

The appetite for risk assets such as stocks and growth-sensitive currencies lifted last Friday, as the cooler-than-expected U.S. NFP jobs report for October drove the 2-year and 10-year Treasury yields as low as 4.80% and 4.50% respectively, boosting all 3 U.S. stock indices to monthly highs.

The jobs growth slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labour market will likely be needed to keep inflation on its downward trajectory.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

All 3 U.S. stock indices have started November on the right footing, posting their best trading week of the year so far last week, on hope for an end to the Federal Reserve’s rate-hiking campaign coupled with the solid Q3 earnings, the soft U.S. NFP data report, the falling crude oil prices, and the weaker U.S. dollar.

The appetite for risk assets such as stocks and growth-sensitive currencies lifted last Friday, as the cooler-than-expected U.S. NFP jobs report for October drove the 2-year and 10-year Treasury yields as low as 4.80% and 4.50% respectively, boosting all 3 U.S. stock indices to monthly highs.

The jobs growth slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labour market will likely be needed to keep inflation on its downward trajectory.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.

All 3 U.S. stock indices have started November on the right footing, posting their best trading week of the year so far last week, on hope for an end to the Federal Reserve’s rate-hiking campaign coupled with the solid Q3 earnings, the soft U.S. NFP data report, the falling crude oil prices, and the weaker U.S. dollar.

The appetite for risk assets such as stocks and growth-sensitive currencies lifted last Friday, as the cooler-than-expected U.S. NFP jobs report for October drove the 2-year and 10-year Treasury yields as low as 4.80% and 4.50% respectively, boosting all 3 U.S. stock indices to monthly highs.

The jobs growth slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labour market will likely be needed to keep inflation on its downward trajectory.

Treasury yields initially eased off their 16-year highs last Wednesday (at 5% on the 10-year bond yield), when the Federal Reserve kept rates unchanged to 5.25%-5.50% for a second straight meeting, lifting the bets that the Fed’s rate-hiking campaign may be over.

Adding to the above, the solid earnings have also brought buyers back into the market as most of the S&P 500 companies have already reported positive quarterly financial results, despite the higher energy prices and elevating borrowing costs.

In this context, the tech-heavy and yield-sensitive Nasdaq Composite finished last week higher by 6.60% at 13,478 recording its best week since November 2022, the S&P 500 index advanced 5.85% to 4,358, while the industry-sensitive Dow Jones index ended the week at 34,061, up by 5.07% in its most winning week since October 2022.

Nasdaq Composite, 2-hour chart

The yield-sensitive technology stocks and the other interest rate-sensitive momentum stocks usually benefit from a drop in Treasury yields, making their profitability less exposed to higher borrowing costs.

The positive investment momentum has also increased from the fact that there were few signs that the conflict in the Middle East would expand into a wider regional war, removing the geopolitical premium from the crude oil prices, with Brent falling to $86/b, and WTI sliding to $81/b.