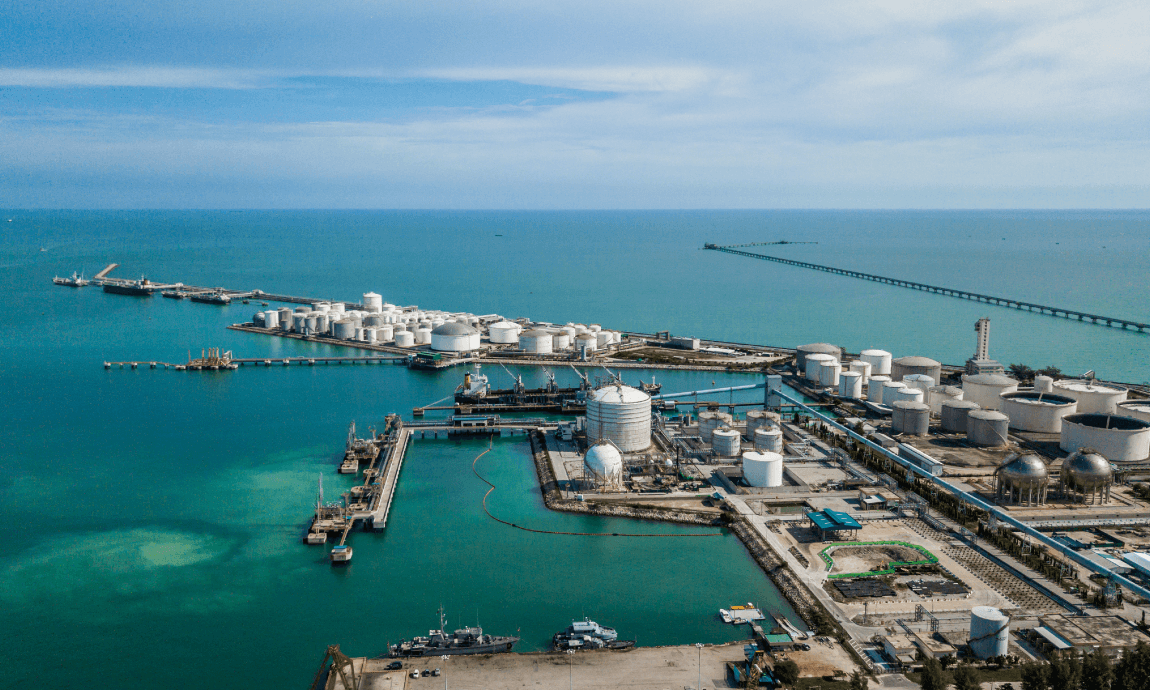

Crude oil prices jumped by 8% on Thursday after US President Donald Trump had talked with leaders of Russia and Saudi Arabia to end their oil price war and save the energy sector from collapse. In addition, the oil prices spiked after reports saying the Chinese government is moving forward with plans to buy crude oil for its emergency reserves. The crude oil prices lost 65% this year on lower petroleum demand from pandemic-related lockdowns and oversupply conditions.

Coronavirus Update:

Global cases: More than 932,600

Global deaths: At least 46,809

Top 5 countries: United States (213,372), Italy (110,574), Spain (104,118), China (82,361), and Germany (77,872).

Market Reaction:

Crude Oil:

The WTI and Brent crude prices rallied by 8% at $22.50 and $27.60 per barrel respectively on Thursday’s European session.

The oil prices showed resilience holding the 18-year lows despite the huge increase in the U.S. crude inventories during US afternoon session. The EIA- U.S. Energy Information Administration reported an increase in the crude inventories by 13.8 million barrels in the week to March 27 to 469.2 million barrels. The figure was the biggest one-week rise since 2016, as the US refineries curb output on lower gasoline and jet fuel demand amid pandemic lockdowns.

Equity Markets:

The US stock markets plunged by 4% on Wednesday as the Manufacturing index fell to 49 in March, signalling a contraction in the U.S. industrial activity during the pandemic. The Dow Jones index closed with 4.44% losses, at 20,943 while the S&P 500 and Nasdaq slid 4.41% to 2,470 and 7,360. The shares of major companies such as stock Apple, Google, JP Morgan and Wells Fargo had more than 5% losses.

However, the US futures were moving higher by 1% this morning on improved sentiment. The Dow futures indicating an opening near 21.200 or 1.2% gains.

The Asian-Pacific markets finished with profits on Thursday morning, following the gains in the US overnight trading and higher commodity prices. The Australian and Korean indices rose by 2% while the Hang Seng followed with 1% gains. The only exemption was the Nikkei index which closed with 1.5% losses.

Safe Havens:

Safe havens Gold and US Treasuries traded higher yesterday due to the stock market sell-off and the weaker economic activity in US and Eurozone. The fast spreading of pandemic in major economies such as US, China and Eurozone have sent investors away from risky assets towards the safety of bullions and bonds.

The Gold price hit intraday highs of $1.600/oz yesterday before retreat to $1.590/oz level, while Silver price extended the gains trading near $14/oz. The yield on the benchmark 10-year Treasury note, dropped below 0.60%, while the yield on the 30-year Treasury bond was pricing near 1.20%.

Forex Market:

The US dollar and Japanese Yen were the strongest currencies across the board during Wednesday session supported from safety bids and the huge losses in the global stock markets. The DXY-dollar index retested the 100 key resistance level yesterday, the USD/JPY pair traded on range between 107-108, while EUR/USD dropped to as low as 1.09 level.

However, the commodities currencies Aussie and Kiwi dollars rebounded this morning following the gains in Asian markets and crude oil prices. The crude oil-related currencies Canadian dollar, Russian Rouble and Norwegian Crone gained more than 0.50% against US dollar.

Economic Calendar for April 2, 2020 (GMT+ 3:00):