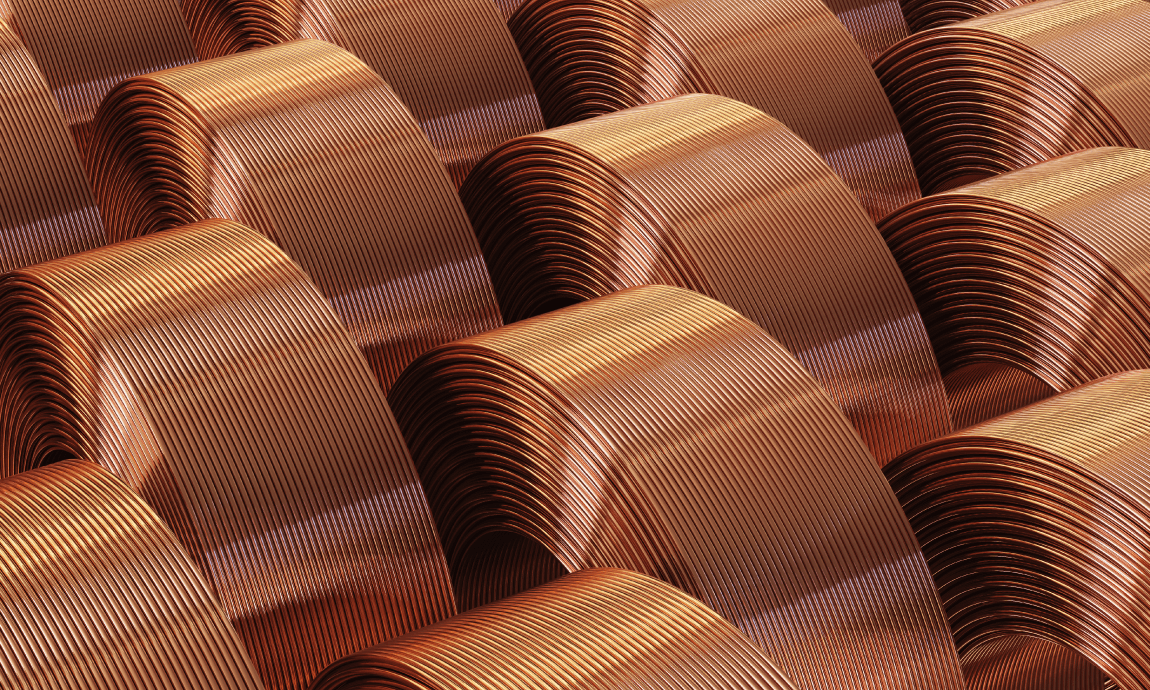

Copper prices have climbed nearly $3 a pound, to their highest in 2 years, gaining support from the recovering demand, as more global economies and industries restarted following the pandemic crisis, in addition to the robust Chinese industrial demand, and the supply disruptions in Chile.

China, which consumes nearly 50% of the global demand for copper, increased its imports to a record high in June, a sign of a recovering industrial activity after the removal of the virus-related lockdown measures in early April.

Furthermore, copper prices have received support from supply disruptions in Chile, the world’s biggest producer of the red metal. Some major copper mines suspended their operations to stop the spread of coronavirus, while miners in other sites in the country voted for strikes on wages and virus protection.

Copper futures for September delivery trade near $2.87 a pound on the Comex metals division of the New York Mercantile Exchange, jumping almost 50% since March 19, when prices hit 2020-intraday bottom. The prices have completely recovered all pandemic-related losses together with the US-China trade war losses from 2019.

Downward pressure on copper prices

The recent rally has lost some steam since the start of the week, over concerns that the demand for the industrial metals could be affected amid the escalation of US-China tensions, the resurgence of COVID-19 cases around the world and the doubts over the resilience of China’s economic recovery.

The US-China relations deteriorated after Trump’s administration ended Hong Kong’s special status under US law in response to China’s new security law against the former British colony. The renewed tension is raising the risk of a new round of economic retaliation between the world’s two largest consumers of industrial metals.